The Personal Loans Canada Statements

Table of ContentsMore About Personal Loans CanadaWhat Does Personal Loans Canada Do?7 Easy Facts About Personal Loans Canada ExplainedIndicators on Personal Loans Canada You Need To KnowEverything about Personal Loans Canada

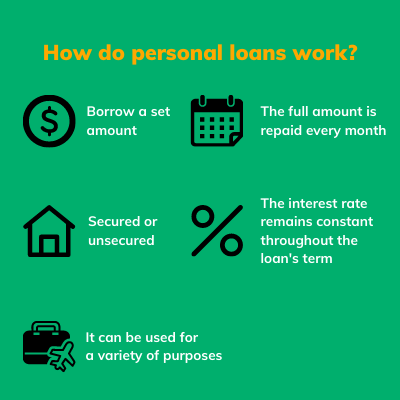

Payment terms at many personal finance lending institutions vary in between one and 7 years. You get all of the funds at the same time and can use them for nearly any type of purpose. Consumers usually utilize them to finance a possession, such as a lorry or a watercraft, pay off financial debt or assistance cover the price of a major cost, like a wedding event or a home restoration.

Personal lendings featured a dealt with principal and interest regular monthly repayment for the life of the financing, determined by accumulating the principal and the rate of interest. A set price provides you the safety of a foreseeable month-to-month repayment, making it a popular choice for combining variable rate bank card. Repayment timelines differ for personal fundings, however consumers are often able to choose payment terms in between one and seven years.

Indicators on Personal Loans Canada You Should Know

You might pay a preliminary origination cost of as much as 10 percent for a personal finance. The fee is usually subtracted from your funds when you complete your application, lowering the quantity of cash you pocket. Personal fundings rates are much more straight linked to brief term prices like the prime rate.

You might be offered a reduced APR for a much shorter term, because loan providers understand your equilibrium will be settled much faster. They might charge a higher rate for longer terms recognizing the longer you have a financing, the more most likely something can change in your finances that can make the payment expensive.

A personal lending is additionally a good choice to using credit report cards, since you obtain money at a set price with a certain benefit day based upon the term you select. Maintain in mind: When the honeymoon mores than, the monthly settlements will certainly be a suggestion of the cash you invested.

The Personal Loans Canada Ideas

Before tackling debt, make use of a personal funding repayment calculator to aid budget plan. Collecting quotes from several lenders can help you spot the very best offer and potentially conserve you passion. Compare interest rates, fees and loan provider reputation prior to getting the loan. Your credit report is a large element in identifying your eligibility for the finance along with the rates of interest.

Before using, know what your score is to ensure that you understand what to anticipate in terms of prices. Be on the hunt for hidden costs and fines by reviewing the loan provider's terms and problems web page so you do not finish up with much less cash money than you require for your economic goals.

They're much easier to qualify for than home equity lendings or other guaranteed loans, you still require to reveal the loan provider you have the ways to pay the funding back. Personal lendings are better than credit history cards if you desire a set month-to-month settlement and require all of your funds at when.

Not known Facts About Personal Loans Canada

Credit cards might also supply benefits or cash-back alternatives that personal fundings do not.

Some loan providers might also charge fees for individual fundings. Personal finances are lendings that can cover a number of individual expenditures.

As you spend, your available debt is reduced. You can after that boost readily available debt by making a settlement toward your credit score line. With an individual lending, there's commonly a fixed end day through which the Read Full Report funding will certainly be repaid. A line of credit, on the various other hand, may stay open and available to you forever as long as your account official website stays in good standing with your loan provider - Personal Loans Canada.

The money received on the loan is not strained. If the lender forgives the finance, it is thought about a canceled financial obligation, and that quantity can be exhausted. A safeguarded individual loan calls for some kind of security as a problem of loaning.

Not known Facts About Personal Loans Canada

An unprotected personal financing requires no collateral to borrow money. Banks, cooperative credit union, and online lenders can offer both safeguarded and unprotected personal loans to qualified debtors. Banks normally take into consideration the you can check here latter to be riskier than the former due to the fact that there's no security to accumulate. That can indicate paying a greater rate of interest for an individual lending.

Once more, this can be a financial institution, credit history union, or online personal lending lender. If approved, you'll be provided the financing terms, which you can accept or decline.